A Tropical Oasis Awaits!

Visit the Garden and explore the sights, sounds, and smells of the #1 Botanic Garden in the United States.

Purchase your tickets online today!

Jurassic Garden Returns!

Jurassic Garden returns! Embark on an awe-inspiring journey through time, surrounded by life-size dinosaurs nestled among our vast collection of cycads and other living plants from the Prehistoric World.

Stay Connected

Hours & Admission

Fairchild is open every day except for Christmas, December 25

Hours

10:00 a.m. – 5:00 p.m.

Admission

Fairchild Members Free

Adults $24.95

Child (6-17) $11.95

Students (with valid ID) $15.95

Seniors (65 and over) $17.95

In-Garden tram rides Free

Parking Free

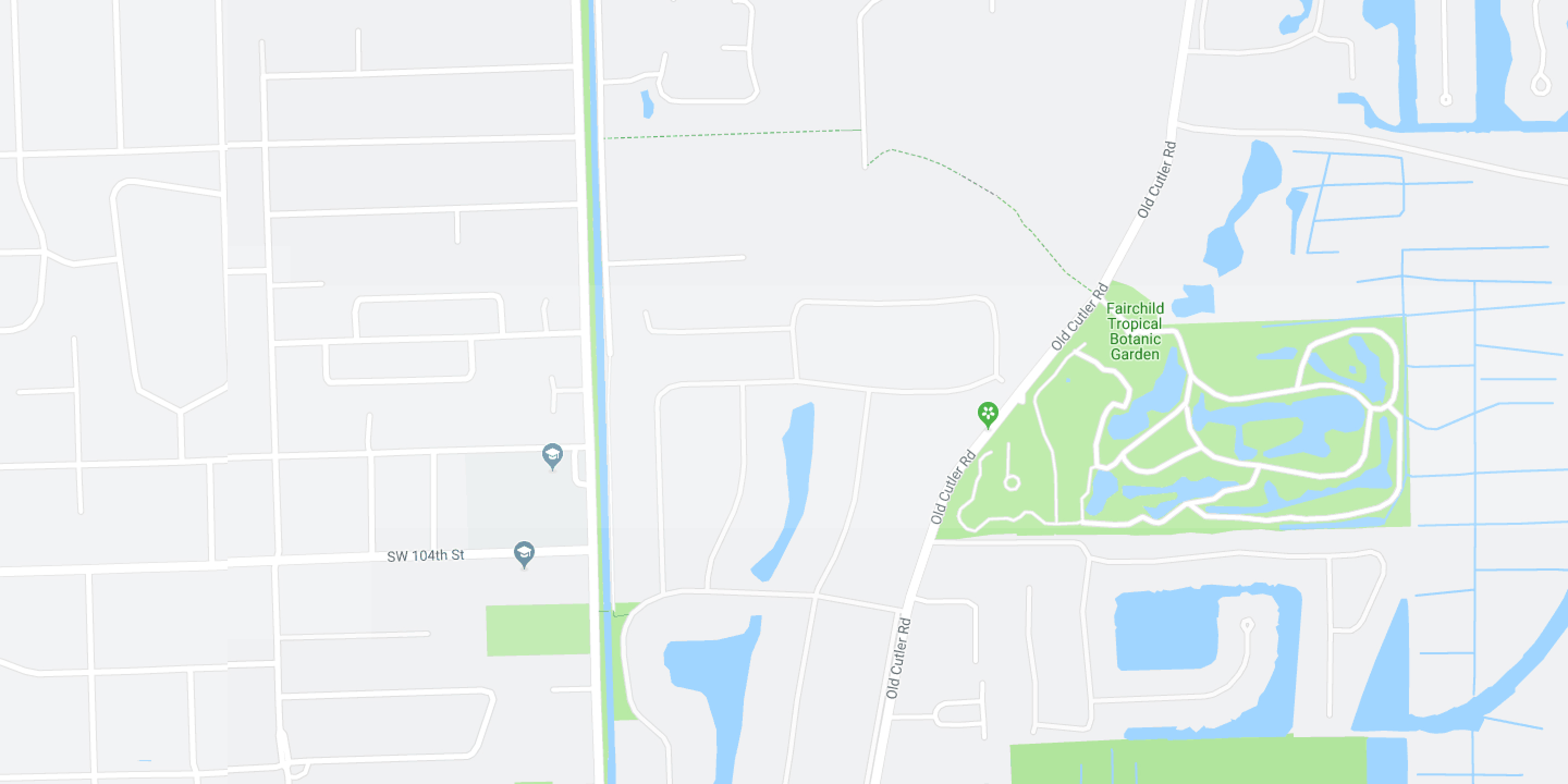

Location

10901 Old Cutler Rd, Miami, FL 33156

MembersGet Tickets Non-Members

Buy Tickets

FOLLOW THE LATEST @fairchildgarden